Creating a Legacy of Wealth After You Die

In order to leave a legacy for future generations, you may have invested years in developing and protecting your legacy. But have you thought about the impact it will have on family members who are in different stages of life after you are gone? It’s crucial that your loved ones are ready for the responsibility and use their inheritance to improve their lives based on the values that have always mattered most to you. The wealth they receive is intended to support family initiatives and may extend to their communities. You may be worried that children and grandchildren will lose motivation and work ethic after they inherit, that some beneficiaries will experience favoritism, or cherished relationships will dissolve over trivial disputes. How can you ensure your legacy is used as intended to achieve a better future?

Generational Priorities

There are generational differences of opinion on the best way to live and interact in the world. Millennials and Generation X have distinctly different priorities concerning environmental, social, and governance issues than older family members. You may want to extend your principles and values regarding climate change, responsible use of resources, health and safety, human rights, social supply chain, or the mission and management of a family business. There may be concerns about how children continue to manage their wealth without your wisdom and guidance. These are legitimate concerns faced during the most significant transfer of wealth in human history.

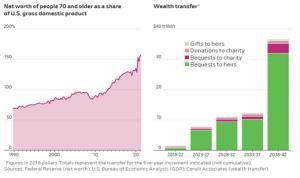

The baby boomer generation controls an enormous stockpile of money currently transferring to younger millennial and GenX family members. The Wall Street Journal reports that from 2018 to 2042, 70 trillion dollars will be redistributed, with some 61 trillion dollars going to family heirs in the United States. The remaining balance will wind up in philanthropic endeavors. This transfer of wealth reflects the outsized economic power of baby boomers, who have been driving the US economy for decades.

Starting the Wealth Transfer Early

Wealth transfer doesn’t have to wait until you die. Many have already begun gifting. The IRS reports annual gifts have recently substantially increased, unleashing a torrent of economic activity such as purchasing homes, starting businesses, creating non-profit organizations to shelter wealth, and donating to charity. You can provide tools and resources to manage assets and income you’ve gifted before or after your death.

Financial Education and Asset Protection

If you intend to improve the lives of the younger family members and the economic activity in your community, then you must understand that your wealth may be driven by younger generations with lower levels of financial literacy. Many struggle with saving and spending habits. Rather than preserving and growing their inheritance for future philanthropic endeavors in a dramatically changing society and world, these generations may spend it on leisure activities, travel, college debt, and health services.

An estate planning attorney understands the importance of generational wealth preservation and goes over various options, including trusts for asset protection and tax-free benefits to loved ones. Guardianships for minors and setting up revocable living trusts (RLTs) maintain and disperse certain asset types in different ways over time. These trusts can contain language instructing family members to set up new trusts for the next generations.

Financial vehicles like 529 tax-advantaged college saving programs and custodial accounts for minors, such as UTMAs/UGMAs, are often used to provide for a child. However, sending checks to your family without instructions on the best way to handle the gift can create unintended problems. Trusts can restrict spending and wait to release funds until minors become adults before inheriting. Your estate plan can address situations where a child receives a scholarship but does not want to attend college. It can set expectations for children who are experiencing addictions. There are many potential problems you can avoid by talking to an estate planning attorney.

Your estate plan can deal with questions and concerns through multiple decades. Estate planning attorneys who address multigenerational wealth transfer issues will structure your legacy plan to meet changing needs, updating the plan to account for significant life events like marriage, divorce, births, and deaths while modifying assets and beneficiaries as necessary. They are also aware of any legal changes that can impact future goals. Your family ideals and financial aspirations are unique. Consulting with an estate planning attorney answers complex questions regarding a successful strategy that provides for a prosperous future.

To speak with one of our experienced elder law and estate planning attorneys, please contact our office today at 1 (800) 680-1717.

Not long ago, my cousin mentioned she’s interested in learning what information is required when writing your estate plan. I believe she’d benefit from reading your insight about working with an estate planning attorney. I’ll email your post to my cousin and suggest she finds an attorney to ensure her assets are protected if she passes away.