Watch “In The Legal Know” with Vincent J. Russo Vincent appeared on CFN Live on…

“Per Stirpes”, “By Representation”, “Per Capita”-What Do They Mean?

If you die without a Last Will and Testament or a Trust, the New York State laws of intestacy will govern the disposition of your property to your “distributees”, your closest living blood relatives (in priority order). However, if you execute a Last Will and Testament or a Trust, you can control the disposition of your property. For this very reason, it is important to seek counsel from an estate planning attorney who can draft a Last Will and Testament or a Trust to fulfill your intentions.

There are three ways to distribute your property to your beneficiaries upon your demise: “Per Stirpes”, “By Representation”, and “Per Capita”. So, what do they mean?

- Per Stirpes is derived from the Latin term meaning “By the Root” or “Down the Line”. It means inheriting property by a right of a deceased ancestor. For example, if your children are your beneficiaries, and a child predeceases you, then the deceased child’s children (your grandchildren), would equally inherit the share of your predeceased child (their respective parent). However, in the event that more than one child predeceases you leaving children (your grandchildren from more than one child), all of your grandchildren, as a generation, would not receive an equal inheritance.

- By Representation means “By Generation”. For example, if your children are your beneficiaries, and a child predeceases you, then the deceased child’s children (your grandchildren), would equally inherit the share of your predeceased child (their respective parent). However, in the event that more than one child predeceases you leaving children (your grandchildren from more than one child), all of your grandchildren, as a generation, would receive an equal inheritance. The shares of all of your predeceased children would be combined and divided equally among the next generation — all of their children (all of your grandchildren) — not just their respective children.

- Per Capita is derived from the Latin term meaning “Per Head”. For example, if your children are your beneficiaries, and a child predeceases you, then your surviving children and the deceased child’s children (your grandchildren) would all receive an equal inheritance.

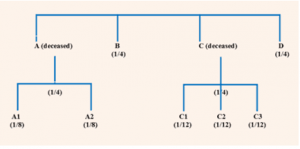

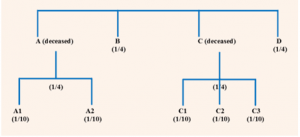

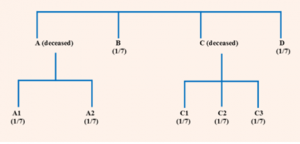

Let’s look at a hypothetical that demonstrates the different dispositions which can result from a Last Will and Testament or a Trust which provides for “my children, per stirpes”, “my children, by representation”, or “my children, per capita”. In this case scenario you have fo,ur (4) children, Child A, Child B, Child C, and Child D, who are each one-fourth (1/4) beneficiaries. You are survived by Child B and Child D. However, Child A and Child C have predeceased you. Child A is survived by two (2) children (A1 and A2) and Child C is survived by three (3) children (C1, C2, and C3). So, you have a total of five (5) grandchildren.

“my children, per stirpes”:

- Child A’s two (2) children equally share Child A’s one-fourth (1/4) share, and each receive a one-eighth (1/8) share.

- Child C’s three (3) children equally share Child C’s one-fourth (1/4) share, and each receive a one-twelfth (1/12) share.

- Child B and Child D each receive a one-fourth (1/4) share.

Pursuant to a disposition to “my children, per stirpes”, the children receive an equal inheritance, but the grandchildren do not receive an equal inheritance.

“my children, by representation”:

- Child A’s two (2) children and Child C’s three (3) children equally share the combined total shares of Child A and Child C (one-half (1/2)), and each receive a one-tenth (1/10) share.

- Child B and Child D each receive a one-fourth (1/4) share.

Pursuant to a disposition to “my children, by representation”, the children, as a generation, receive an equal inheritance, and the grandchildren, as a generation, receive an equal inheritance.

“my children, per capita”:

- Child A’s two (2) children and Child C’s three (3) children and Child B and Child D equally share the combined total shares of all children A, B, C, and D, and each receive a one-seventh (1/7) share.

Pursuant to a disposition to “my children, per capita”, all of the children and grandchildren receive an equal inheritance.

As you can see, the ultimate distribution of your property to your children and grandchildren can vary significantly depending upon the whether the disposition is “per stirpes”, “by representation”, or “per capita”. So, if you do not want your property to be subject to intestate distribution and you do want to control how your property passes (especially in the event that a beneficiary of your Last Will and Testament or your Trust predeceases you), you should retain an estate planning attorney to draft a Last Will and Testament or a Trust that clearly states your intentions. On the other hand, if you are a beneficiary of a Last Will and Testament or a Trust, it is important that you retain a Trusts and Estates attorney to represent your interests as a beneficiary and to insure that you receive your proper inheritance.

Russo Law Group, P.C. has attorneys experienced with estate planning and beneficiary representation. We invite you to take advantage of our comprehensive website as well as our free seminars and webinars to learn more about how Russo Law Group, P.C. may assist you.

This Post Has 0 Comments