This originally aired on the Catholic Faith Network’s show CFN Live: https://youtu.be/aQgwbQkJtC0 How can SSI…

Vincent Russo on CFN Live – Protecting Your Residence with a Medicaid Asset Protection Trust?

Watch Vincent J. Russo Legal Correspondent on Catholic Faith Network’s CFN Live!

Vincent appeared on CFN Live on February 23rd to discuss

“Protecting Your Residence with a Medicaid Asset Protection Trust?”

Colleen: Today, we are introducing a four-part series on Trusts and Medicaid with Vincent J. Russo “In the Legal Know”.

Vincent:

Colleen. I am excited to bring this four-part series to our viewers at CFN.

Trusts can be a powerful vehicle in maximizing government benefits, in particular Medicaid. In this four-part series, we will take a look at various Trusts that can protect assets while accessing Medicaid for seniors and people with disabilities.

Today I will address how a particular type of Trust – the Medicaid Asset Protection Trust, can allow seniors to qualify for Medicaid long-term care at home or in a nursing while protecting their home and other assets.

This is very important because Medicare does not cover long-term care services which can be very expensive. Without Medicaid, a senior will have to spend down their assets, losing their ability to stay at home and lose all of one’s assets.

Colleen:

Vincent, let’s start with: How does owning a home impact a senior’s eligibility for Medicaid long-term care?

Vincent:

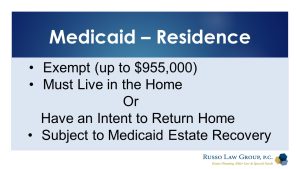

The basic rule is that your home is exempt if it is worth less than $955,000.

For example, if you apply for Medicaid home care, your home will not be counted against you in regard to the asset test for Medicaid eligibility (which is $16,800).

The same is trust for nursing home care as long as you have an intent to return home.

So, doing nothing seem ok BUT there is a catch.

As a general rule, the home is not exempt from a Medicaid estate claim when you pass away. Medicaid will seek reimbursement against your estate (including your home) for the services provided by Medicaid.

If your home is transferred to a Medicaid Asset Protection Trust, then there is no Medicaid estate recovery against your home.

The home is there for you to live in. If circumstances change, you can sell the home, buy another home or invest the sales proceeds in the Trust.

In summary, the Medicaid Asset Protection Trust which funded with your residence (can also be funded with other assets) can allow you to be:

- Eligible for Medicaid home care,

- Eligible for Medicaid nursing home care after 5 years from when the trust is transferred to the Trust (as a general rule),

- While avoiding a Medicaid estate recovery when you pass away

Colleen: Does the senior have all the rights of ownership when the residence is placed in the trust?

Vincent:

As a practical matter, yes but legally the residence is owned by the Trust.

The senior has the exclusive right to live in the home, qualify for senior’s real estate exemptions (such as Star), as well as being treated the owner for tax purposes.

An added bonus is that the residence avoids probate on the individual’s demise.

Colleen: Are there other options available to seniors?

Vincent:

Absolutely, when transferring a residence, there are a number of exceptions to the Medicaid transfer penalty rule which should be explored as part of any long-term care plan.

Every situation must be analyzed and a plan created to meet the needs of the senior. One size does not fit all.

The Medicaid rules are very complex and confusing. As my law firm, we have a free Medicaid planning guide that can be downloaded on vjrussolaw.com.

Today, I presented the general rules of how it works in New York and the rules can also vary State by State.

Colleen: Vincent, can you give us a glimpse of what will you be covering with us on March 1st?

Vincent:

We will take a look at Pooled Trusts which allow seniors to protect their income while receiving Medicaid home care services.

For more information on these topics and more, you can download for free our Planning Guides from our law firm website at vjrussolaw.com

Vincent can be found on past CFN Live episodes by clicking here.

Topics include:

- NYS Medicaid Home Care Program Changes

- Estate Planning Basics Part 1: Why do I need an Estate Plan?

- Estate Planning Basics Part 2: What is Included in an Estate Plan?

- Estate Planning Basics Part 3: When and Why do I need to update my Estate Plan?

- Estate Planning for Children with Special Needs Part 1: How do I provide for and protect my child?

- Estate Planning for Children with Special Needs Part 2: What Government Benefits are Available?

- Estate Planning for Children with Special Needs Part 3: What Steps Do I Need to Take for my Adult Child with Special Needs?

- Long Term Care Planning Part 1: “How Do I Pay for Long Term Care?”

- Long Term Care Planning Part 2: “How Can Medicaid Home Care Help Me?”

- Long Term Care Planning Part 3: “How to Qualify for Medicaid”

- What is a Power of Attorney?

- Important Legal Updates

We hope you tune in to CFN Live. It is a dynamic show with current news and fascinating contributors who have inspiring stories to tell. The new show CFN Live airs Monday through Friday at 9 am & 7:00 pm. You will be able to watch the show anytime, at your convenience, on the CFN YouTube Channel.

at 9 am & 7:00 pm. You will be able to watch the show anytime, at your convenience, on the CFN YouTube Channel.

You can learn more about the Catholic Faith Network and CFN Live by visiting https://www.catholicfaithnetwork.org/cfn-live.

Russo Law Group’s Managing Partner, Vincent J. Russo, is a featured contributor on the Catholic Faith Network’s new show CFN Live. Vincent is the show’s Legal Correspondent. In his segment, entitled “In the Legal Know,” Vincent will keep you abreast of the latest legal developments including elder law, special needs and estate planning — all to help you make informed planning decisions to protect yourself, your loved ones, and your assets.

Russo Law Group’s Managing Partner, Vincent J. Russo, is a featured contributor on the Catholic Faith Network’s new show CFN Live. Vincent is the show’s Legal Correspondent. In his segment, entitled “In the Legal Know,” Vincent will keep you abreast of the latest legal developments including elder law, special needs and estate planning — all to help you make informed planning decisions to protect yourself, your loved ones, and your assets.

This Post Has 0 Comments